IT Solutions

Digital Transformation in Banking

Imperatives, Strategies, and the Future of Finance

Apr 4, 2024

Banking, once an industry synonymous with tradition, is in the midst of a digital revolution. Customer expectations are evolving, regulations are tightening, and disruptive FinTech players are forcing banks to innovate or risk obsolescence. Let's explore digital transformation strategies for banks, common pitfalls to avoid, and the technologies shaping the future of financial services.

Why Does Digital Transformation Matter for Banks?

Enhanced Customer Experience (CX): Modern consumers demand seamless, personalised banking experiences across mobile devices, online platforms, and even in-branch interactions. Digital transformation is key to meeting these omnichannel needs.

Operational Efficiency: Automation, data analytics, and streamlining of processes drive efficiency, lower costs, and free up resources for strategic initiatives.

Risk Management and Compliance: Advanced analytics and secure digital platforms are essential to managing risks within an increasingly regulated environment.

Competitive Advantage: Early adopters of digital innovation will outpace their competitors, attracting more customers and offering better products and services.

Key Digital Transformation Initiatives for Banks

Mobile and Online Banking: Intuitive mobile apps and user-friendly online banking platforms are no longer a "nice-to-have," they're table stakes.

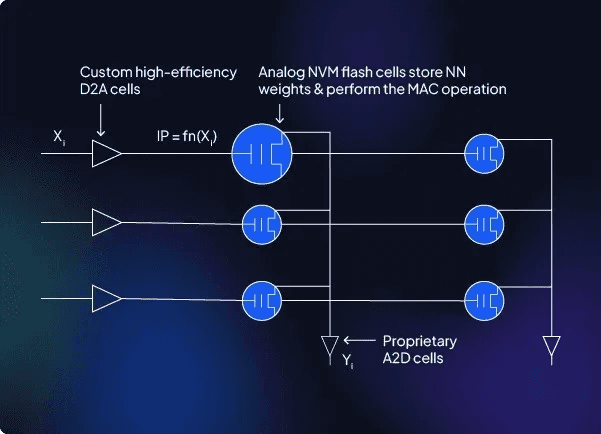

Data Analytics and AI: Harnessing the power of data with analytics tools and artificial intelligence provides insights for personalized offers, fraud detection, and improved decision-making.

Cloud Adoption: The cloud provides scalability, flexibility, and cost efficiency for banking operations, making innovation more accessible.

API Adoption: Utilizing APIs (Application Programming Interfaces) enables banks to integrate with third-party services and FinTech solutions easily.

Cybersecurity: Robust cybersecurity measures are non-negotiable. Banks must prioritize data protection and threat detection to maintain customer trust.

Overcoming Challenges in Banking Digital Transformation

Legacy Systems: Integrating new technologies with outdated systems can be complex and costly. Phasing out old systems strategically is crucial.

Resistance to Change: Change management strategies and employee upskilling are necessary to ensure buy-in across the organisation.

Regulation and Security: Banks must navigate a complex regulatory landscape while ensuring data privacy and security throughout the transformation process.

The Future of Banking is Digital

Disruptive technologies like blockchain, biometrics, and open banking have the potential to further reshape the industry. Banks that embrace digital transformation can anticipate:

Hyper-Personalisation: AI-powered tools will offer tailored products and services unique to each customer.

Smarter Lending and Risk Assessment: Alternative data sources and analytics will transform credit scoring and lending processes.

Frictionless Payments: Invisible payments and advanced authentication will streamline transactions for customers.

For our Services, feel free to reach out to us via meeting…

Please share our content for further education